Egypt’s eCommerce market has been growing at an impressive rate in recent years thanks to increased internet penetration, smartphone usage, and a growing middle class that is driving the growth in online shopping. Between 2023 and 2027, Egyptian eCommerce revenue is expected to show an annual growth rate of 14.46%—and reach a projected market volume of US $11.63 billion by 2027.

Businesses, both B2B and B2C, are eager to take advantage of this opportunity and establish their presence in the Egyptian market.

Exploring Egypt’s Growing eCommerce Market

Unveiling the Egyptian eCommerce boom: eye-opening statistics and market insights

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| In 2023, eCommerce user penetration will be 55.4% and will likely hit 70.1% by 2027 | |

| Egyptian consumers purchased 3.4% of their goods online in 2022, with a projected increase to 4.5% by 2025. | |

| About 60% of Egyptian online shoppers are between 18 and 34, driven by the young, tech-savvy population and the widespread mobile internet use. | |

| Electronics and media is the leading market in the Egyptian eCommerce sector, contributing to 23.6% of the total revenue. Second to this is fashion, which holds a share of 21.8%. | |

| The Egyptian supply chain presents challenges (including controlling delivery costs and meeting high customer expectations who want fast service and same-day deliveries. | |

| Many Egyptian consumers prefer cash-on-delivery (COD) because they don’t have credit cards. However, credit card issuance is increasing, indicating potential shifts in payment preferences. |

| The average revenue per user (ARPU) in the Egyptian eCommerce market is expected to be US $108.60 in 2023. | |

| The number of Egyptian eCommerce users could reach more than 84 million users by 2027—a vast majority of the country’s approximately 111.8 million people | |

| Egypt’s internet penetration rate is over 72%—higher than the worldwide average of 64.6% in 2023. | |

| The entry barriers for B2C eCommerce in Egypt are relatively low—aspiring business owners can set up an online store with just their smartphone and internet access. Still, success requires investment in infrastructure, operational capabilities, and expertise in engaging and supporting customers. | |

| Merchants prioritize building trust with online consumers in Egypt to compete, emphasizing brand recognition, user experience, payment options, delivery tracking, clear returns policies, and customer support. |

| In 2023, eCommerce user penetration will be 55.4% and will likely hit 70.1% by 2027 | |

| Egyptian consumers purchased 3.4% of their goods online in 2022, with a projected increase to 4.5% by 2025. | |

| About 60% of Egyptian online shoppers are between 18 and 34, driven by the young, tech-savvy population and the widespread mobile internet use. | |

| The entry barriers for B2C eCommerce in Egypt are relatively low—aspiring business owners can set up an online store with just their smartphone and internet access. Still, success requires investment in infrastructure, operational capabilities, and expertise in engaging and supporting customers. | |

| The Egyptian supply chain presents challenges (including controlling delivery costs and meeting high customer expectations who want fast service and same-day deliveries. | |

| Many Egyptian consumers prefer cash-on-delivery (COD) because they don’t have credit cards. However, credit card issuance is increasing, indicating potential shifts in payment preferences. |

| The average revenue per user (ARPU) in the Egyptian eCommerce market is expected to be US $108.60 in 2023. | |

| The number of Egyptian eCommerce users could reach more than 84 million users by 2027—a vast majority of the country’s approximately 111.8 million people | |

| Egypt’s internet penetration rate is over 72%—higher than the worldwide average of 64.6% in 2023. | |

| Electronics and media is the leading market in the Egyptian eCommerce sector, contributing to 23.6% of the total revenue. Second to this is fashion, which holds a share of 21.8%. | |

| Merchants prioritize building trust with online consumers in Egypt to compete, emphasizing brand recognition, user experience, payment options, delivery tracking, clear returns policies, and customer support. |

Global Payments

Insights Report

Ready to streamline your payment and payout processes?

Download our free Global Payments Insights

Report and discover how the latest trends - and big picture changes / strategies (not sure what word here) - can help you optimize your payment and payout strategy and operations.

Take Part in Egypt’s eCommerce Revolution with MassPay’s Hyper-Localized Payment Solution

In a country where trust is essential, MassPay’s hyper-localized payment solution ensures customers have multiple options for paying how they prefer—all while providing merchants with increased flexibility and security.

When customers pay through an eCommerce platform powered by MassPay, their data is encrypted and stored on local servers to increase security and reduce the risk of fraud. MassPay’s solution provides eCommerce merchants with comprehensive payment options and services to get them up and running quickly in Egypt.

We deliver hyper-localized transaction processing, allowing merchants to process payments via in-region payment processors to increase authorization rates, increase conversions and make more money.

We also offer a range of payout solutions including mobile wallets, prepaid cards, and online banking transfers, to ensure your payees get the best experience possible.

How Merchants Navigate Egypt’s eCommerce and Fintech Market

With MassPay, merchants can focus on their core business and leave payment processing to us. Our integrated platform eliminates the complexity of dealing with multiple third-party providers, giving merchants:

Fast and secure payments with their customers’ chosen methods

Scalability to grow and adapt as the business landscape and consumer behaviors shift

With MassPay at the helm of payment solutions, businesses in Egypt can confidently navigate the waves of the eCommerce and Fintech seas, focusing on growth and customer satisfaction.

Payment preferences (in local currency)

When Egyptians shop online, they expect their payment options to be tailored toward local preferences. MassPay’s localized payment solutions make it easy for merchants to accept payments in Egyptian pounds (EGP), US dollars (USD), and other locally preferred alternative payment methods.

Optimized payment processing

Don’t let payment processing slow you down. When merchants can accept customer payments quickly and securely, they can succeed in Egypt’s eCommerce market. With optimized checkout experiences tailored to the needs of your customer base, you ensure a seamless purchase process every time—keeping your customers coming back for more.

Open API

Customize your payments and payout experiences with MassPay’s Open API. With access to the underlying technology, Egypt merchants can develop unique payment solutions or enhance existing integrations to ensure they always get the most out of their online business.

Payouts

In a largely cash-based economy like Egypt, the ability to receive payments quickly and securely is essential for merchants. Help your customers receive payments in their choice of local currency almost instantly - eliminating long wait times that could slow down your business.

Our comprehensive payment platform lets you move quickly and confidently in the Egyptian market.

Secure and reliable technology

When building consumer trust, you need to know that your chosen payment platform offers robust security measures. Our secure infrastructure and advanced fraud prevention features help you protect your payment data and uphold the trust of your customers.

With our customer support team available around the clock, MassPay provides merchants with a complete set of tools to make their eCommerce experience in Egypt as seamless as possible.

The Egyptian Payment Market

Your success in the Egyptian eCommerce market depends on your ability to offer customers convenient and secure payment methods. With capabilities that support leading payment and payout options, Egyptian customers can easily make payments and receive funds with the power of MassPay.

With streamlined payment processing and support for leading payment options, MassPay helps you optimize your customer experience by reducing checkout times and transaction errors. Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Egypt and propelling your success. Don’t wait—try MassPay today.

Egyptian Payment Methods

You must offer their preferred payment methods to reach Egypt's broadest possible customer base possible.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Cash

![]()

Cash is still widely used and accepted in Egypt. Many people prefer to use cash for everyday transactions, especially for smaller purchases or in less developed areas where electronic payment infrastructure may be limited. In many parts of Egypt (especially tourist areas), cash machines are pretty standard and accessible.

Debit/credit cards

![]()

![]()

Many Egyptians use debit and credit cards for eCommerce transactions and various other purchases. Well-known brands like Visa, Mastercard, and American Express are recognized, and credit cards from local and international banks are also accepted.

Along with eCommerce purchases, Egyptians often use debit/credit at hotels, restaurants, and brick-and-mortar retail stores. As of 2022, about 22% of online eCommerce payments were done with cards in Egypt.

Mobile payment apps

![]()

![]()

Mobile payment apps have gained popularity in Egypt, providing users with a convenient and secure way to pay using their smartphones. Popular mobile payment apps in Egypt include Vodafone Cash, Orange Money, and Etisalat Flous. These help users send money, pay bills, and make purchases at participating merchants.

These have caught on relatively quickly, and as of 2022, about 14% of eCommerce payments took place with digital wallets.

Bank transfers

![]()

Bank transfers are commonly used for larger transactions in places like Egypt, the Philippines, Mexico, and China. Usually, that means paying bills, making business payments, or transferring funds between bank accounts. Customers can initiate bank transfers through online banking platforms or by visiting their respective bank branches.

When your payment platform supports bank transfers, customers can select this payment method and enter their bank details during checkout. Allowing customers to pay with bank transfers can help attract buyers who are looking for merchants supporting this payment option.

Prepaid cards

![]()

Prepaid cards are available in Egypt and can be used for online purchases or as an alternative to cash. Egyptians can load these cards with a specific amount of money and use them with merchants that accept prepaid cards.

Cash on Delivery (COD)

![]()

Egyptians are fond of cash-on-delivery (COD) payments, and many prefer to pay for their purchases with cash upon delivery. This method is prevalent in rural areas and among shoppers who don’t have access to credit cards or other electronic payment methods. With it, customers can pay for things they buy online with cash upon delivery of the goods.

Customers without access to credit or debit cards or who don’t want to use them for online transactions tend to prefer this option. For those customers, this can be their only purchase option.

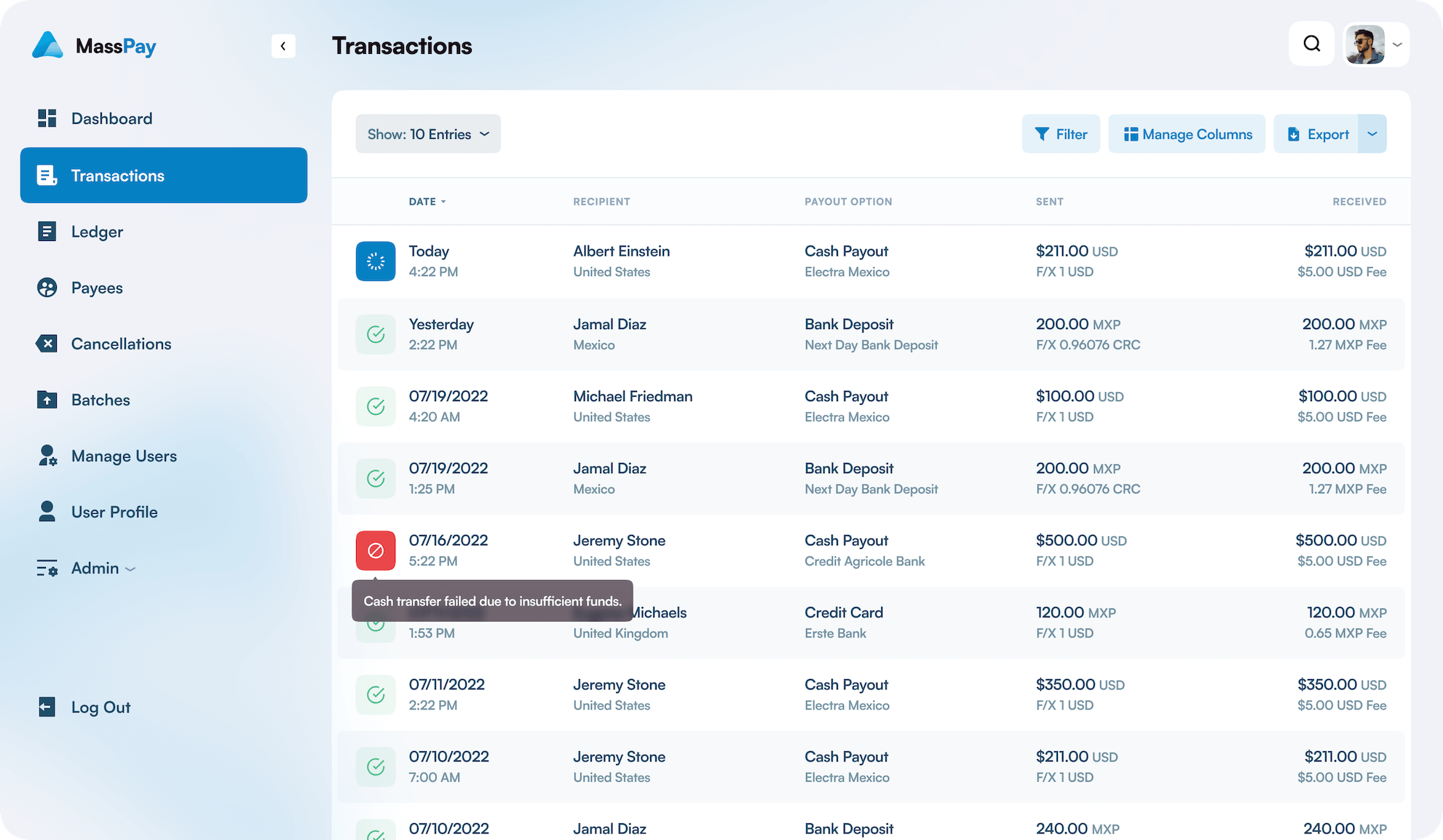

Detailed Reporting

COMPREHENSIVE DATA

Immediate access to real-time reporting provides comprehensive visibility into your operations. No matter what you're looking for, or where you're looking for it, it's right at your fingertips.