The Philippines has seen unprecedented growth as the country continues to make giant strides in digital transformation. This rapid cross-sector digitization has opened up exciting new opportunities in the eCommerce market. With the second largest population in Southeast Asia, the Philippines is quickly becoming a primary destination for businesses looking to capitalize on the region’s growth.

Digital Transformation in the Philippines

Digital Trends in the Philippines

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| In 2023, the BSP is poised to exceed its target of transforming 50% of the traditional retail payments into digital. | |

| In 2022 there were 47.27 million digital commerce users in the Philippines. | |

| The Filipino population is one of the most tech savvy countries—the country is fourth in the world when it comes to total time spent online. |

| The Philippine central bank, Bangko Sentral ng Pilipinas (BSP), has been actively involved in the country’s digital payment transformation. BSP initiated its Digital Transformation Road to promote growth and development of digital payment innovations. | |

| Rising inflation is impacting the card payment market. In January 2023, BSP raised the interest rate on credit cards to 3% per month, up from 2% per month. As a result, populations have actively relied on multiple methods to make payments. |

Although digital solutions are experiencing significant growth, cash remains a primary option for many Filipinos. Many employees receive their salaries in cash, especially in smaller businesses or the informal sector.

|

|

Many primary expenses such as rent, food, and other necessities are paid for in cash. However, use of mobile money or bank transfers to pay bills is increasing. |

| Even workers who receive digital wages have a heavy reliance on ATMs due to the lack of infrastructure to support the widespread adoption of digital payments. |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

Surge in eCommerce Market

The country’s digital transformation has subsequently had a positive impact on the eCommerce market. More consumers and businesses are relying on the efficiency, convenience and safety of online shopping opportunities to meet the needs for a wide array of goods and services.

There are several key factors contributing to eCommerce growth in the Philippines including:

- In 2023, there were 85 million internet users in the Philippines.

- The B2C eCommerce market in the Philippines is expected to grow by 15.44% to reach US$14.2 billion in 2023.

- In 2021, eCommerce totaled $17 billion, with forecasts predicting a 17% increase by 2025.

- There were 168 million cellular mobile connections active in early 2023, which is 144% of the country's total population. A vast majority of online markets access platforms via smartphones.

- 72% of the population uses social media, enabling eCommerce platforms to capitalize with online marketing utilizing social media trends.

Filipinos rely on various payment methods, including unique options like Virtual Accounts, QRPh, Digital Wallets and Buy Now Pay Later.

Empowering Merchants in the Philippines’ Booming eCommerce and Fintech Landscape

With MassPay's hyper-localized transaction processing, merchants in the Philippines can utilize in-region payment processors, leading to streamline its entry into this rapidly growing market:

Enhanced conversion rates

Amplified revenue streams

Whether they're in Manila, Cebu, Davao, or a remote part of the archipelago, Filipino customers prioritize local payment methods effortlessly incorporated into the checkout experience. This level of convenience, coupled with the growing trust in digital solutions, is precisely what MassPay delivers to businesses eager to thrive in the Philippines.

Payout preferences (in local currency)

MassPay has the capacity to adapt to the unique payment preferences in the Philippines. Although digital payment methods continue to grow, cash remains a significant payment method in the Philippines. Being able to offer payment options in local currency, Philippine peso (PHP), helps businesses build stronger relationships with employees, partners and consumers.

Payments

Merchants can send payouts to customers efficiently with MassPay’s end-to-end payment services. MassPay accounts for the reliance of cash in the Philippines along with other payment methods to deliver quick payment options using local methods.

Security and state-of-the-art technology

The BSP wants to ensure that as the country grows digitally, consumers are protected from threats. Many online users in the Philippines are new. They have concerns about their data and security.

MassPay boasts state-of-the-art security measures to protect businesses from fraud and losses due to chargebacks or failed payments. It also uses advanced encryption technology for data protection and complies with the highest security standards.

MassPays safeguards give customers the peace of mind they deserve.

Optimized payment processing

MassPay’s solutions cater to the market in the Philippines. Filipino customers want to be able to easily make payments and receive funds. The deep understanding of how consumers make payments, guides MassPay’s strategy. From QRPh to e-Wallets, MassPay offers the right solutions to seamlessly integrate businesses into the eCommerce market in the Philippines.

By providing multiple payment options, businesses can offer consumers the safety, convenience, and accessibility they need.

The Philippine Payout Market

The Philippines offers immense opportunities for businesses looking to expand their operations both in-country and in the Southeast Asian region. By understanding the local payment landscape and leveraging the latest fintech trends, you can navigate this dynamic market successfully.

MassPay provides hyper-localized payment orchestration solutions tailored to your needs, ensuring seamless integration and optimizing your payment and payout strategies.

Download The Complete Guide to Payout Orchestration (URL) to discover how MassPay's cutting-edge technologies and trends can help you streamline your payout processes and optimize your payment strategy. With our comprehensive solutions, you can confidently enter the vibrant Philippines market and unlock its vast potential.

Get ready to revolutionize your payments in the Philippines with MassPay!

Philippine Payment Methods

Merchants looking to tap into the Filipino eCommerce market must ensure several types of payment options are readily available. The most common payment methods in the Philippines include e-Wallets, Buy Now Pay Later, Debit and Credit Cards, Direct Debit, and QRPh.

The Philippines has experienced a surge in non-cash payment methods with the governments pushing to utilize digital payment methods during the pandemic.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

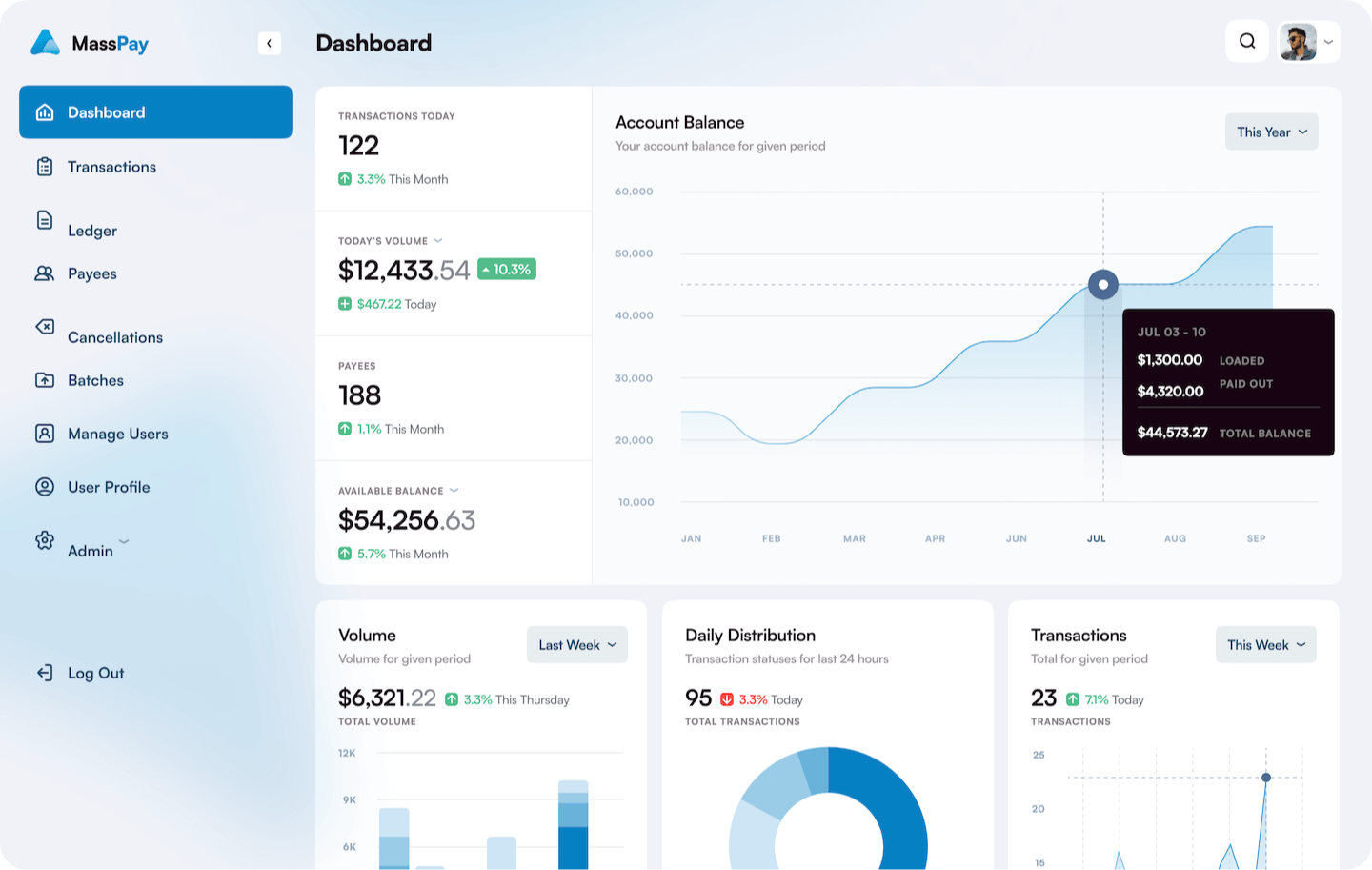

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Debit and credit cards

![]()

In 2023, card payments in the Philippines are expected to grow by 10% to hit PHP2.5 trillion (US$45.3 billion). The Filipino government has made intensive moves to enhance the country’s banking infrastructure.

When it comes to usage, the amount of debit cards in circulation sits at 126 million, significantly higher than the 10.9 million credit cards.

However, credit and charge cards are by far the payment method of choice accounting for 53.1% of card payments by value in 2022. This is due to installment payment options and reward programs.

Bank transfers

![]()

As more and more of the population becomes integrated with banking institutions, the use of banking services, electronic fund transfers have become increasingly common. Companies, government agencies, and individuals are increasingly using bank transfers to send money to recipients' accounts.

Cash

![]()

Cash remains king for many consumers in the Philippines. More than half of the population lives outside of major metropolitan areas. Traditionally, cash is key for many due to many not having access to reliable banking infrastructure.

PayLater

![]()

The Buy Now Pay Later (BNPL) payment option has recorded strong growth. BNPL payments are expected to grow by 22.5% in 2023. BNPL has increased in popularity due to rising inflation rates, and the rapid growth of eCommerce in the country.

BSP National QR Code Standard

![]()

The BSP National QR Code Standard, or QRPh for short, is one of the most recent digital payment solutions enacted by the central bank. The system furthers the move to grow digital payments in the country. QRPh requires consumers to scan QR codes created by banks and electronic money issuers to make payments.

QRPh started as a payment method for Person-to-Person transactions, and now has expanded as a Person-to-Merchant service. The BSP has onboarded more than 160,000 sites to the P2M QR system.

Digital wallets

![]()

The number of mobile wallet users in the Philippines is forecasted to reach approximately 65 million by 2025. The wave of digital transformation is starting to reach populations that are unbanked, providing convenience and accessible payment methods.

Consumers outside major metro areas like Manila, Davao and Cebu continue to grow when it comes to online shopping with 54% of first-time online shoppers living in the non-metro areas.

Direct debit

![]()

Direct debit continues to be a viable payment model in the Philippines. Direct debit is the process where an institution automatically withdraw payments directly from a customer’s bank account.

Direct debit is a convenient option for recurring payments since it often comes at no cost. Many bank institutions are offering direct debit options to keep up with the digital wallet solutions. Direct debit allows Filipinos to process payments without using debit or credit cards.

Over-the-Counter (OTC) Payments

![]()

Over-the-counter (OTC) payments are a great solution for Philippine merchants to support unbanked consumers. As noted, cash is still heavily relied on in the Philippines. OTC Payments allow customers to complete purchases online through interacting with store clerks. OTC payments are readily in practice at department and convenience stores throughout the country.

OTC payments have expanded the reach of online businesses, particularly among traditional buyers who are not fully accustomed to digital payment methods. More and more retail stores are offering OTC as a means to connect offline shoppers to online resources.