The Singapore payments market is forecasted to register a CAGR of 7.5% from 2022 to 2027, in line with the government’s efforts to drive digitalization and real-time payments. This growth is driven by many things, including new payment solutions such as mobile wallets, which are being adopted by eager consumers and businesses nationwide.

UNLEASH THE POWER OF SINGAPORE’S THRIVING PAYMENTS MARKET

Mobile commerce drives Singapore’s eCommerce boom

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| Singapore has one of the highest internet penetration rates globally–96.9% (or 5.81 million people) at the beginning of 2023–meaning the vast majority of the population has access to the internet. This widespread internet usage has created a conducive environment for eCommerce growth. | |

| As one of the most affluent countries in Asia, per capita income is $65,000. The eCommerce market has an exceptional value of its own: it’s expected to reach US $10 billion by 2026. | |

| Singapore has the highest basket size among all Southeast Asian countries at $67.40. This represents an exciting opportunity for eager merchants to capitalize on. |

| Mobile commerce is a significant driver of eCommerce in Singapore. With the increasing adoption of smartphones and mobile devices, consumers increasingly use mobile platforms for online shopping, leading to the growth of mobile commerce. | |

| With over three million eCommerce users, 58% of Singapore residents make online purchases. | |

| Shopee is the top eCommerce platform in Singapore, followed by Lazada and Amazon. |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

Global Payments

Insights Report

Ready to streamline your payment and payout processes?

Download our free Global Payments Insights

Report and discover how the latest trends - and big picture changes / strategies (not sure what word here) - can help you optimize your payment and payout strategy and operations.

Take part in Singapore’s eCommerce scene with MassPay’s localized solutions for payments and payouts

Singapore is an ever-growing payments market with exciting opportunities for merchants hoping to establish or expand their eCommerce presence.

At MassPay, we provide tailored solutions for businesses in Singapore to help you make the most of the payments market and grow your business with timesaving payouts and payments processes.

We know cards remain the top payment choice in Singapore, including for eCommerce sales, and that’s why we offer a secure card payment solution to help you accept payments.

But cards aren’t the only payment method Singaporeans rely on. That’s why our platform also works with:

- Alternative payments

- Digital wallets

- Bank transfers

- Prepaid cards

- Cash pickups

We offer both localized APIs, as well as our easy-to-use dashboard, to help you streamline your payments and payouts.

Empowering Merchants in Singapore’s Booming eCommerce and Fintech Landscape

As a hub of innovation and commerce, Singapore demands cutting-edge payment solutions to cater to both its tech-savvy consumers and burgeoning businesses.

With MassPay's specialized offering, merchants in the Lion City benefit from:

Seamless integration with local and international payment channels

Advanced security measures ensuring safe and trustworthy transactions

Whether serving local Singaporean clientele or reaching out to international customers, MassPay ensures businesses in Singapore have the tools they need to succeed in this fast-paced digital landscape.

Payout preferences (in SGD and 70+ other currencies)

To offer a genuinely hyper-localized and comprehensive payment experience, MassPay offers payout solutions in Singaporean Dollars (SGD) and 70+ other currencies. This allows your customers to receive payments in the currency they prefer and trust.

Real-time payouts

MassPay’s real-time payouts mean you can rest assured knowing customers will receive their payments quickly and securely. With high-speed transfers, we ensure your customers have access to their money when needed.

Secure and compliant transactions

Your customers’ data—and yours—is secure with us with 24/7 monitoring from our dedicated security team.

We provide two-factor authentication, requiring customers to enter a unique code sent to their mobile device or email address in addition to their username and password for account access. MassPay also utilizes advanced fraud detection measures, including machine learning algorithms, to identify and prevent fraudulent transactions.

In terms of compliance, MassPay complies with international security standards and regulations, including GDPR and PCI DSS Level 1. This ensures our solutions fit into your payment and payout processes seamlessly.

Payment processing

Regarding payment processing, MassPay provides a fast, reliable solution with no middlemen and low fees. This allows you to accept payments easily from customers around the world.

Local and international redundancy

One of the most time-consuming parts of international payments is dealing with multiple payment providers. MassPay solves this by offering both local and international redundancy, so you don’t have to worry about finding the right provider or getting hit with unexpected fees.

Forex tools

International businesses often find themselves dealing with the complexities of exchanging currencies. MassPay’s Forex tools help you manage foreign exchange risk and get the best rates for currency conversions.

The Singapore Payout Market

To thrive in Singapore’s payout market, merchants must offer customers fast and secure payments. MassPay’s suite of tailored payment solutions helps you meet the needs of this dynamic eCommerce landscape, allowing you to provide a convenient and reliable service for your customers.

With our comprehensive payout solutions, you can give Singaporeans the localized experience they expect from their preferred payment provider. Whether it’s cash pickups or digital wallets, MassPay has the tools to ensure every customer is taken care of—and every transaction is secure and compliant.

Singaporean Payment Methods

Tap into Singapore’s thriving eCommerce market with MassPay—our seamless onboarding process and effortless integration enable you to get up and running quickly.

MassPay’s tailored payment and payout solutions for Singapore cater to the unique needs of this lucrative eCommerce market. Adopting a hyper-localized approach provides customers with their preferred payment and payout options, ensuring a smooth and convenient shopping experience.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

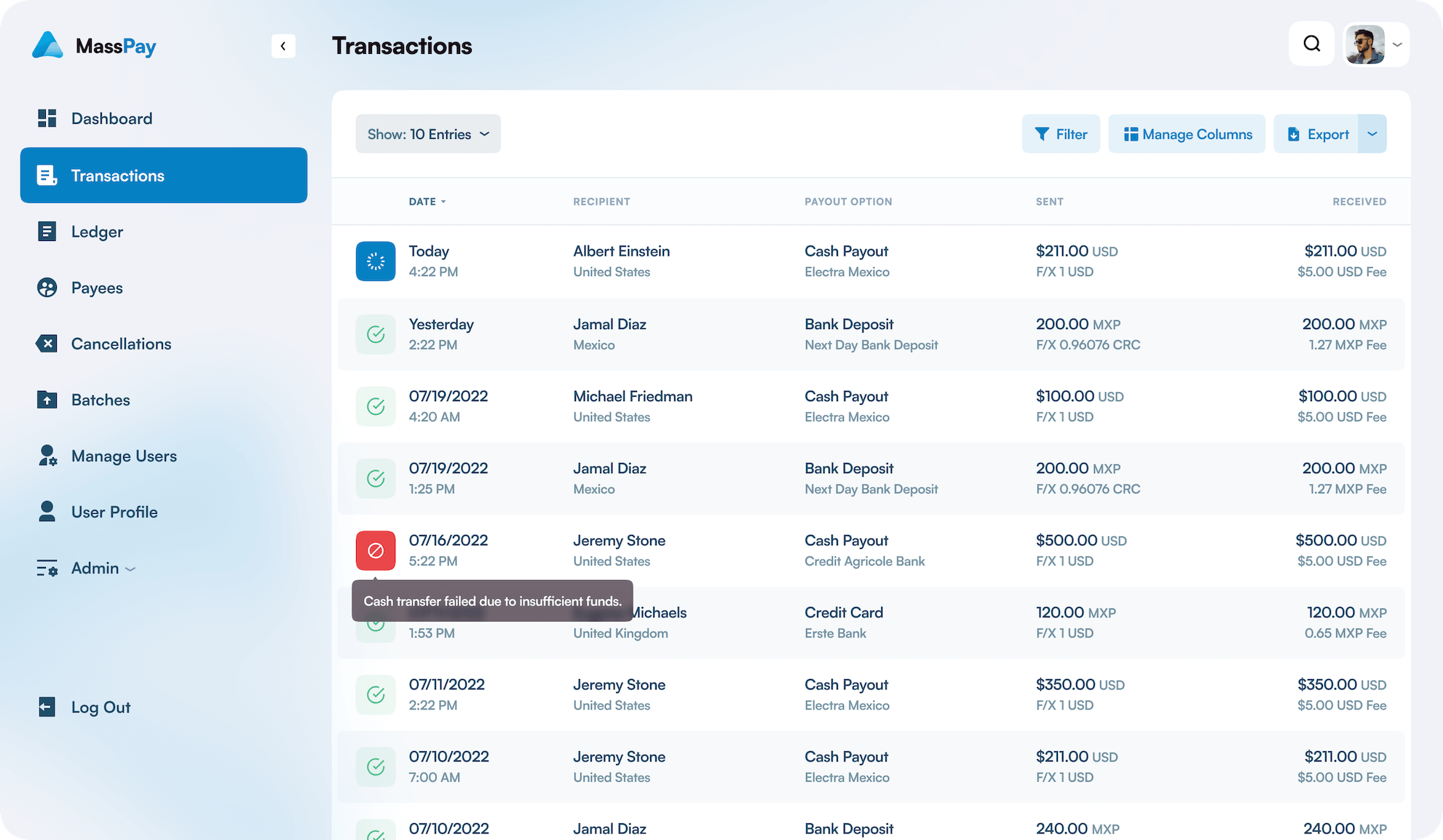

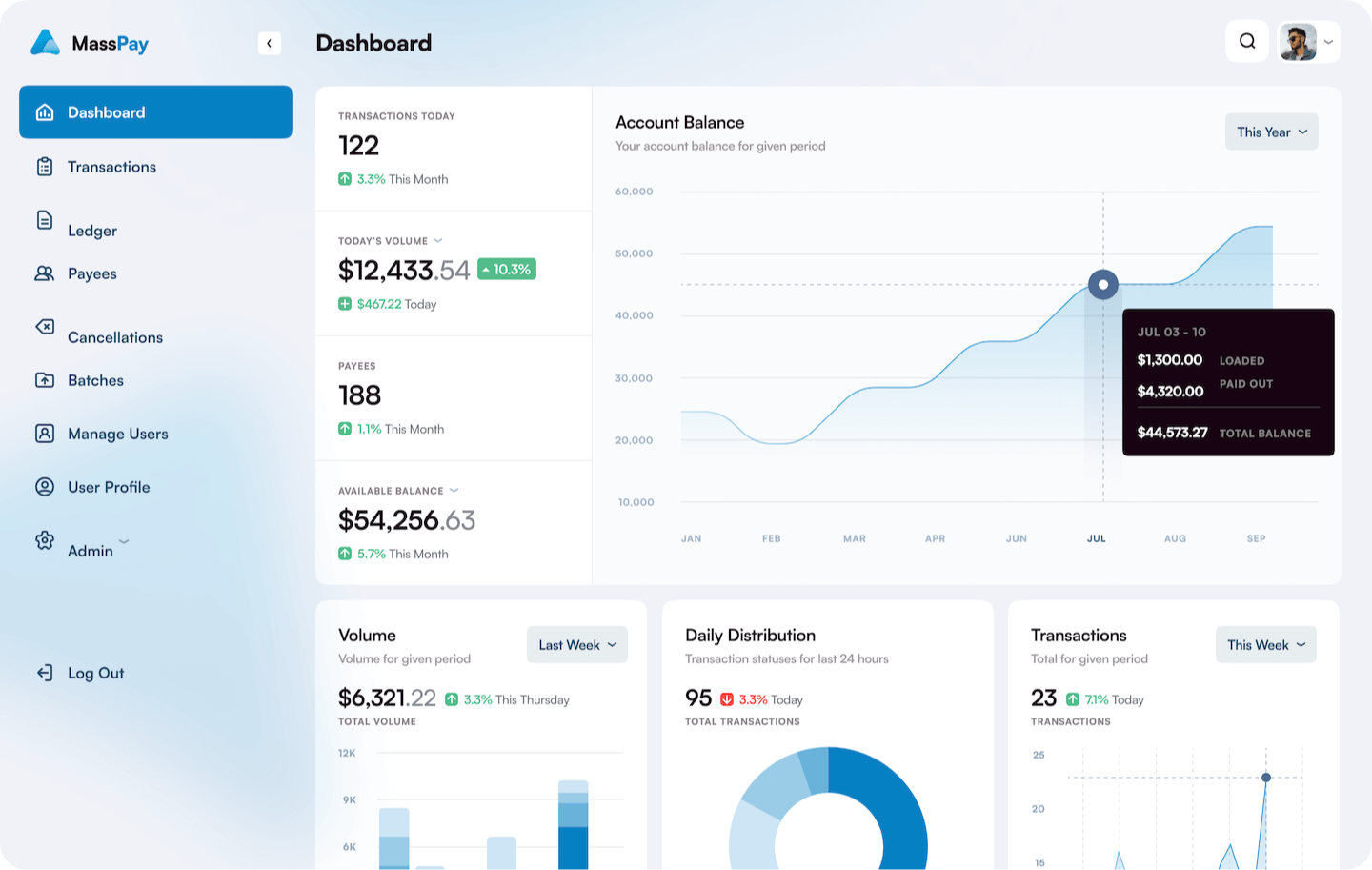

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Cards

![]()

According to recent statistics, over 73% of Singaporeans have at least one credit card. Merchants need a payment platform that supports significant card networks such as Mastercard, Visa, American Express, and Discover. MassPay makes it easy to accept these credit cards with our secure payment solutions.

Cash

![]()

![]()

Although cards lead the way in popularity, many Singaporeans still use cash for everyday purchases. MassPay supports cash pickups, allowing recipients to collect funds from a designated location conveniently. To use this method, you provide the recipient’s name and pickup location, and the transfer will typically be available for pickup within a few hours.

Digital wallets

![]()

![]()

Singaporeans are increasingly using mobile wallets for their day-to-day payments. With MassPay’s digital wallet payment solutions, you can give customers the convenience of paying with major eWallets like GrabPay, Google Pay, and Singapore’s most popular platform: DBS PayLah!.

Bank transfers

![]()

Our bank transfer solution allows customers to make payments via their local banks in SEPA countries, ASEAN countries, and more. You’ll also be able to simultaneously process funds from multiple banking sources—without switching between countries or currencies.

Cross-border payments and remittances

![]()

Especially when it comes to eCommerce, cross-border payments are becoming more and more popular. MassPay facilitates this by allowing customers to pay in their local currency, eliminating the risk of exchange rate fluctuations. You’ll also have access to our network of banking partners for quick and secure international remittances.

Detailed Reporting

COMPREHENSIVE DATA

Immediate access to real-time reporting provides comprehensive visibility into your operations. No matter what you're looking for, or where you're looking for it, it's right at your fingertips.