The Dominican Republic, known for its beautiful beaches and rich cultural heritage, is proving to be a vibrant and promising eCommerce landscape too. In a recent ranking, it has even surpassed Croatia, securing its position as the 74th largest eCommerce market in the world. With a projected revenue of $1,337.4 million by 2023, this Caribbean nation is growing in appeal for businesses seeking international expansion.

Its strategic location, growing digital infrastructure, and a population eager to embrace online shopping contribute to the favorable conditions for eCommerce success in the Dominican Republic. As more businesses recognize its potential, the eCommerce industry in this tropical paradise is poised to thrive in the coming years.

The Dominican eCommerce:

Promising Statistics

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| There are 9.2 million mobile phone connections (equal to 79% of the population) and 8.59 million Internet users (equal to 74% of the population) in the Dominican Republic. | |

| The pandemic accelerated the adoption of eCommerce. Big supermarkets and department stores developed online shopping platforms, and mobile delivery apps saw explosive growth. | |

| The most significant shift in B2C eCommerce has been seen in the banking and telecommunications sectors. Hotels and fast-food restaurants are increasingly adopting online booking and ordering systems. | |

| Roughly two million Dominicans live in the USA, forming a growing niche market for goods and services ordered from the U.S. but delivered to the Dominican Republic. |

| Most international eCommerce transactions are with the United States, although products from China and other Asian countries are also competitive. | |

| Mobile devices are predominantly used for business purposes among SMEs, with a 45% penetration rate. | |

| There are nearly eight million active users on Facebook, making the Dominican Republic one of the most active populations on social media in Central America and the Caribbean. |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

Global Payments

Insights Report

Ready to streamline your payment and payout processes?

Download our free Global Payments Insights

Report and discover how the latest trends - and big picture changes / strategies (not sure what word here) - can help you optimize your payment and payout strategy and operations.

Leveraging MassPay’s Localized Payment Solutions in the Dominican Republic

Understanding local payment intricacies is critical for businesses looking to thrive in this burgeoning market. The Dominican Republic, much like other rapidly growing economies, offers a mix of traditional and modern payment methods.

Companies can confidently navigate the waters of the Dominican payment landscape with MassPay, offering solutions aligned with local preferences. From processing transactions that cater to the unique market to integrating with local and regional payment gateways, MassPay enables businesses to reach new heights.

Empowering Merchants in Dominican Republic’s Booming eCommerce and Fintech Landscape

MassPay’s specialized solutions for the Dominican Republic’s unique market landscape ensure:

Streamlined Payment Gateway Integration: Seamless compatibility with local and international payment systems allows businesses to reach customers wherever they are.

Advanced Fraud Prevention: Enhanced security measures designed to counteract the unique fraud risks inherent to the Dominican eCommerce market.

With MassPay, companies guarantee efficient and smooth transactions and plug into the heart of the Dominican Republic’s rapidly evolving eCommerce environment, setting the stage for long-term success.

Secure and reliable

technology

Security remains a top priority for businesses and consumers alike. MassPay’s integration and orchestration with critical providers in the region results in security and reliability our customers rely on. With MassPay's advanced fraud protection solutions, you can be confident critical data, payments and payouts are managed and processed securely.

Payout and payment

preferences (in local

currency)

Dominican Pesos (DOP) payment solutions can significantly strengthen a business’s connection with local consumers. MassPay’s services integrate seamlessly with the most common local payment methods.

Simplified payment processing

With its compatibility with popular payment forms, you can effortlessly reach Dominican consumers, ensuring their payments are processed seamlessly, securely, and without any delays. This tailored approach provides a unique opportunity for businesses to build a strong presence in the Dominican market and build trust with their customers.

Forex

Designed to empower companies with competitive exchange rates and fee structures, MassPay provides the perfect platform to maximize profit potential while effectively managing risk in currency-related transactions. With MassPay’s comprehensive suite of tools and expert guidance, you can quickly and confidently navigate the dynamic world of foreign exchange.

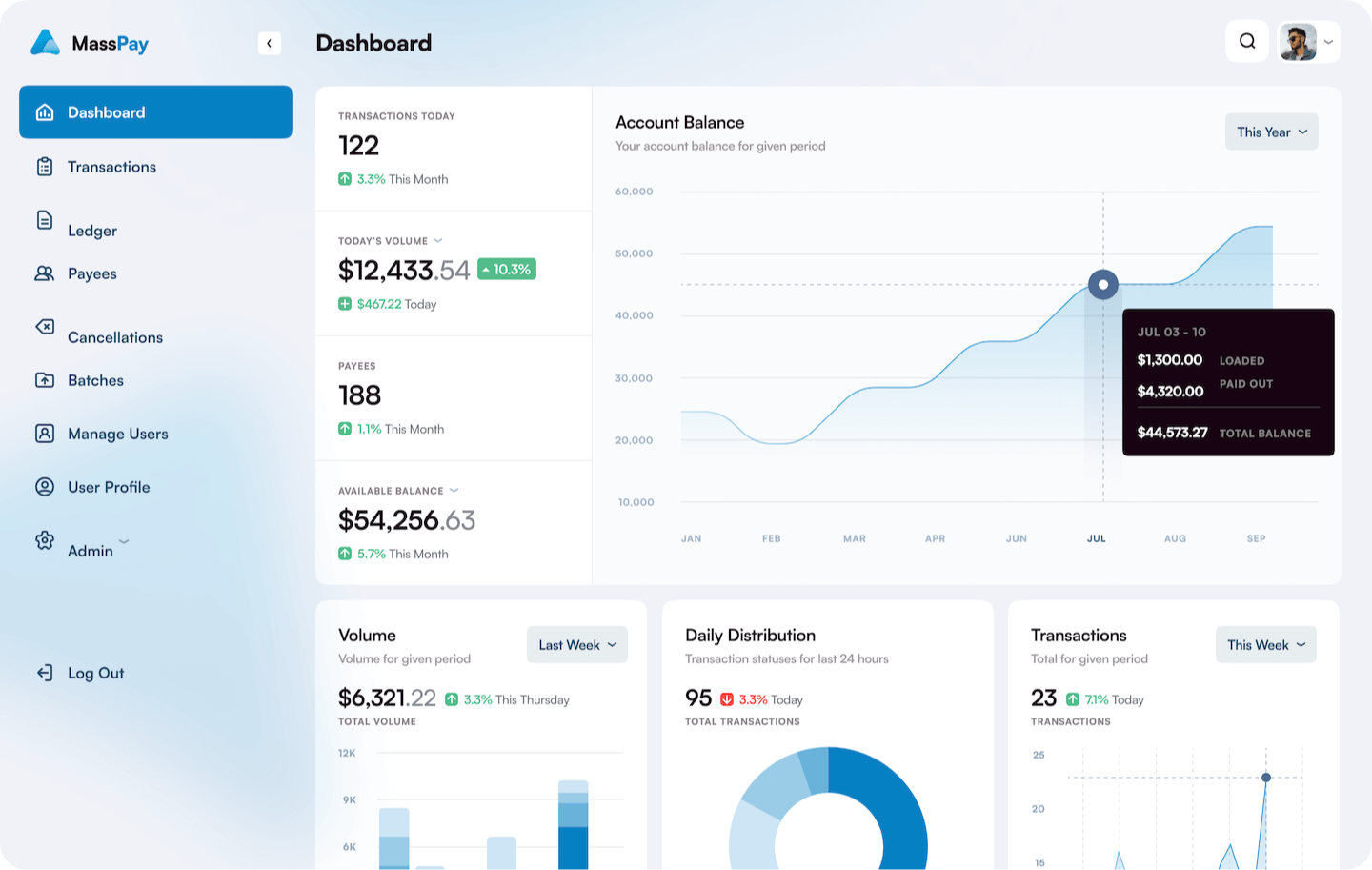

Real-time reporting and analytics

MassPay gives customers real-time access to payment reports and analytics, allowing for better oversight and control of their business processes. This helps businesses optimize cash flow management and reduce costs associated with administrative activities.

Payouts in the Dominican Republic

In addition to facilitating payments, MassPay also offers comprehensive payout solutions in the Dominican Republic. This includes receiving and disbursing funds quickly and securely to any bank account.

With MassPay’s extensive network of local banks and service providers, businesses can now easily send payouts without worrying about high fees or long wait times. Consider MassPay your one-stop solution for secure and convenient payments and payouts in the Dominican Republic.

Popular Payment Methods in the Dominican Republic

A variety of payment methods have helped make the Dominican Republic a prime destination for eCommerce growth in the region. By utilizing MassPay’s secure and efficient payment processing platform, businesses can take advantage of these popular payment methods while reaping the rewards of increased sales and customer satisfaction.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

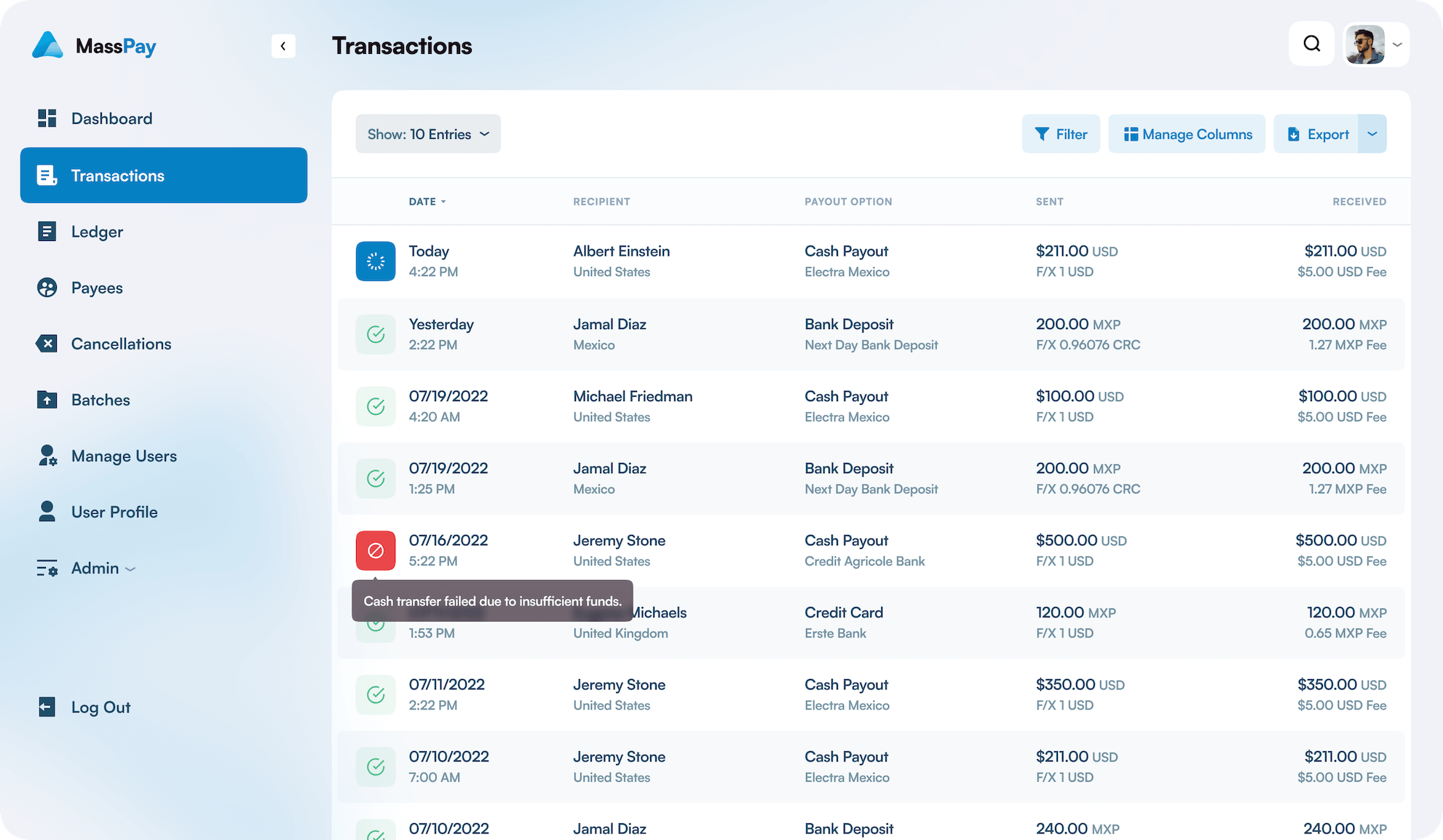

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Cash

![]()

![]()

In the Dominican Republic, many businesses accept payments in cash, making it one of the most popular payment methods in the country as well as most others.

Credit and debit cards

![]()

![]()

Debit and credit cards are the most common payment method for online transactions in the Dominican Republic. MassPay supports various card brands, so you can be sure most customers have access to their preferred payment option.

Bank transfers

![]()

![]()

Online banking is a widely preferred and convenient payment method in the DR. With secure and user-friendly features, individuals can easily manage their finances, transfer funds, pay bills, and access account information anytime, anywhere.

This digital solution has revolutionized how financial transactions are carried out, facilitating a seamless and efficient experience to users in the country.

Mobile Payments

![]()

Mobile payments are growing in popularity in the Dominican Republic, and MassPay can fully accept payments made through leading mobile wallet apps.

Electronic Funds Transfer (EFT)

![]()

EFT payments involve transferring funds electronically from one bank account to another. Through MassPay’s secure platform, businesses can easily accept EFT payments and access real-time transaction data for improved oversight and control of their payment processing.

Detailed Reporting

COMPREHENSIVE DATA

Immediate access to real-time reporting provides comprehensive visibility into your operations. No matter what you're looking for, or where you're looking for it, it's right at your fingertips.