While it’s often celebrated for its breathtaking landscapes, historic ruins, and rich Mayan heritage, Guatemala is also emerging as a dynamic force in eCommerce. Recent evaluations place it as the 64th largest eCommerce market globally, even outpacing Bolivia. With a forecasted revenue of US$1,827.4 million in 2023, Guatemala beckons businesses eyeing international growth.

Its central location in the Americas, advancing digital network, and a populace quickly adopting online shopping combine to make Guatemala a fertile ground for eCommerce ventures. As its potential becomes more evident, businesses worldwide are turning their eyes toward the promising prospects of Guatemala's digital marketplace.

Guatemalan eCommerce:

An Overview of Impressive Metrics

![]() As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

![]() Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

![]() Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

![]() Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

![]() Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

![]() 30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

| Amidst a population of over 17 million, there was a notable shift to online shopping, especially during the pandemic, exemplifying the populace's increasing comfort with digital transactions. | |

| The COVID-19 pandemic brought significant change. Mainstream markets and retail chains ventured into the online space, and there was a noteworthy rise in the usage of delivery apps. | |

| Guatemala's B2C eCommerce dynamics are evident in sectors like electronics, clothing, and personal care, with an increasing number of businesses going digital. | |

| Many Guatemalans have familial or business ties in the United States, establishing a robust conduit for goods and services ordered from the U.S. but delivered to Guatemala. | |

| A study in 2021 by the Guatemalan Chamber of Commerce revealed half of Guatemalans shopped online in 2020. |

| Most of Guatemala's international eCommerce transactions are with the U.S., though European and Mexican markets are also gaining traction. | |

| Mobile devices are becoming indispensable tools for Guatemalan businesses, especially among SMEs, as digital integration accelerates. | |

| Social media engagement is strong, with platforms like Facebook having a significant user base, illustrating Guatemala's robust digital presence in Central America. | |

| International online sales and local online sales in 2020 grew by 60% and 118%, respectively. | |

| The Guatemalan government and some institutions have adopted eCommerce, offering interactive services online. | |

| In 2020, over US$240 million was billed nationwide from online sales. |

-

As of 2021, Mexico had 89.5 million internet users, which accounted for 75.7% of the population over six

-

Cash remains a major payment method in Mexico. In 2021, it was the most commonly used payment method for purchases under MXN500 ($24.79), with 90.1% of Mexicans (75.4 million people) using cash, 6.2% using debit cards, 1.2% using credit cards, and 2.1% using other payment instruments.

-

Security concerns and a large informal sector are obstacles to Mexico's digital ecosystem

-

Mexico's internet users predominantly use smartphones to access the internet, with 98% relying on them for connectivity

-

Only 22% of Mexico's internet users buy goods online, and just 17.6% conduct banking operations online

-

30% of Mexico's internet users are concerned about online fraud, and 28% are not willing to share banking information online

Global Payments

Insights Report

Ready to streamline your payment and payout processes?

Download our free Global Payments Insights

Report and discover how the latest trends - and big picture changes / strategies (not sure what word here) - can help you optimize your payment and payout strategy and operations.

Harnessing MassPay's Customized Payment Solutions for the Guatemalan Market

Understanding local payment intricacies is critical for businesses looking to thrive in this burgeoning market. The Dominican Republic, much like other rapidly growing economies, offers a mix of traditional and modern payment methods.

Companies can confidently navigate the waters of the Dominican payment landscape with MassPay, offering solutions aligned with local preferences. From processing transactions that cater to the unique market to integrating with local and regional payment gateways, MassPay enables businesses to reach new heights.

Empowering Merchants in Guatemala’s Booming eCommerce and Fintech Landscape

MassPay's tailored solutions for Guatemala's distinct market dynamics include:

Effortless Payment Gateway Integration: Smooth integrations with both local and international payment channels, broadening your business's reach.

Proactive Fraud Detection: Robust security features tailored to the unique challenges of the Guatemalan eCommerce market.

By harnessing MassPay, businesses can ensure transactional excellence, placing themselves at the heart of Guatemala's rapidly evolving digital commerce space, thereby laying a robust foundation for long-term prosperity.

Safe and regulatory-compliant transactions

MassPay emphasizes rigorous security measures, leveraging cutting-edge technologies to shield transactional data. Our rigorous safety protocols meet the industry's highest benchmarks, guaranteeing total transactional safety.

Payout and payment

preferences (in local

currency)

Transactions in the Guatemalan Quetzal (GTQ) significantly enhance a brand's rapport with local shoppers. MassPay seamlessly adapts to the predominant local payment techniques.

Simplified transaction handling

MassPay's compatibility with leading payment modalities guarantees smooth interactions with Guatemalan consumers. This targeted approach enhances business visibility and fosters trust with local clients.

Forex Solutions

MassPay offers a platform furnished with competitive exchange rates and transparent fee structures. With our comprehensive toolkit and expert insights, navigating the intricate realm of foreign exchange becomes a breeze.

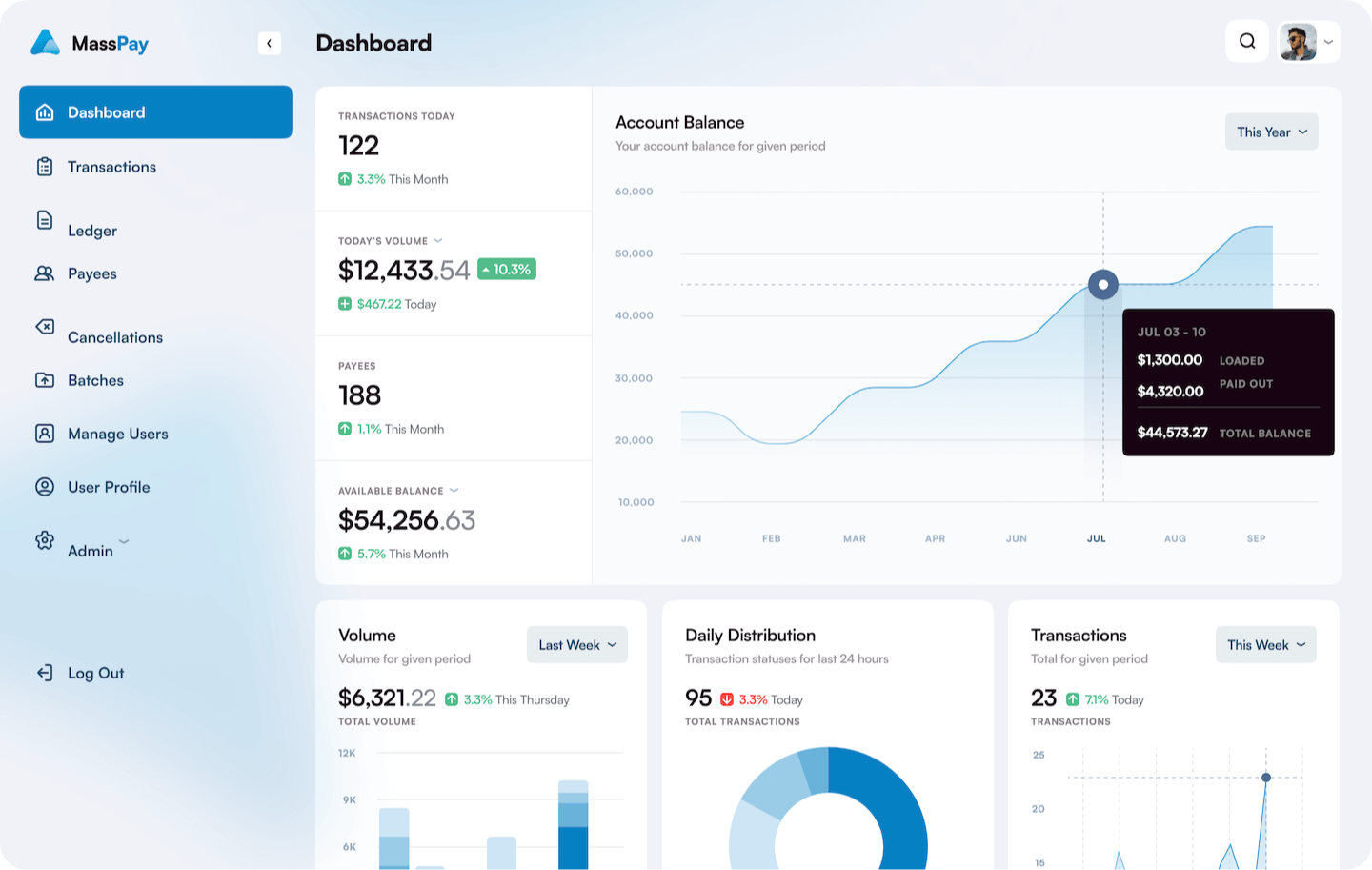

Real-time data and analytics

MassPay equips businesses with instant access to transactional reports and metrics, granting them superior control over operational strategies and aiding in optimizing financial management.

Popular Payment Methods in Guatemala

With its booming e-commerce industry, Guatemala has embraced diverse online payment methods to foster seamless shopping experiences for its vast digital consumer base. With platforms like TecnoCommerce leading the charge, businesses can harness the power of these prevalent payment methods to ensure increased sales and elevated customer satisfaction.

Global Payouts

Built for the Gig Economy.

Give your talent flexibility & full control of their funds with payouts on demand in 175+ countries & 70+ currencies.

Payout and payment preferences

(in local currency)

Cash remains a significant payment method in Mexico—we provide tailored solutions to accommodate this. Cash pickup services as payouts allow customers to send payments with near-instant delivery and withdraw funds from central Mexican banks, including Banco Azteca.

Our payout service lets you make payments in local currency, MXN, so Mexican customers can avoid foreign transaction fees and other associated costs. Along with pesos, USD, and other major currencies, MassPay supports payments in 70+ global currencies—including crypto.

Optimized payment processing

With capabilities that support leading payment and payout options, Mexican customers can easily make payments and receive funds. Streamlined payment processing helps you optimize your customer experience by reducing checkout times and transaction errors.

Optimized payment processing also eliminates the need for manual reconciliation processes, further streamlining your payment operations in Mexico.

Simplify Administration

Say goodbye to complexity. We take care of accounting & reconciliation details and more. You focus on growing your platform.

No More Tax Forms

Your talent is global. We take care of the 1099 & 1042 process for you. You focus on growing your platform.

Reward Your Talent

Help them grow their business.Incentivize quality and increase completion rates.Postdate payments until customers are happy.

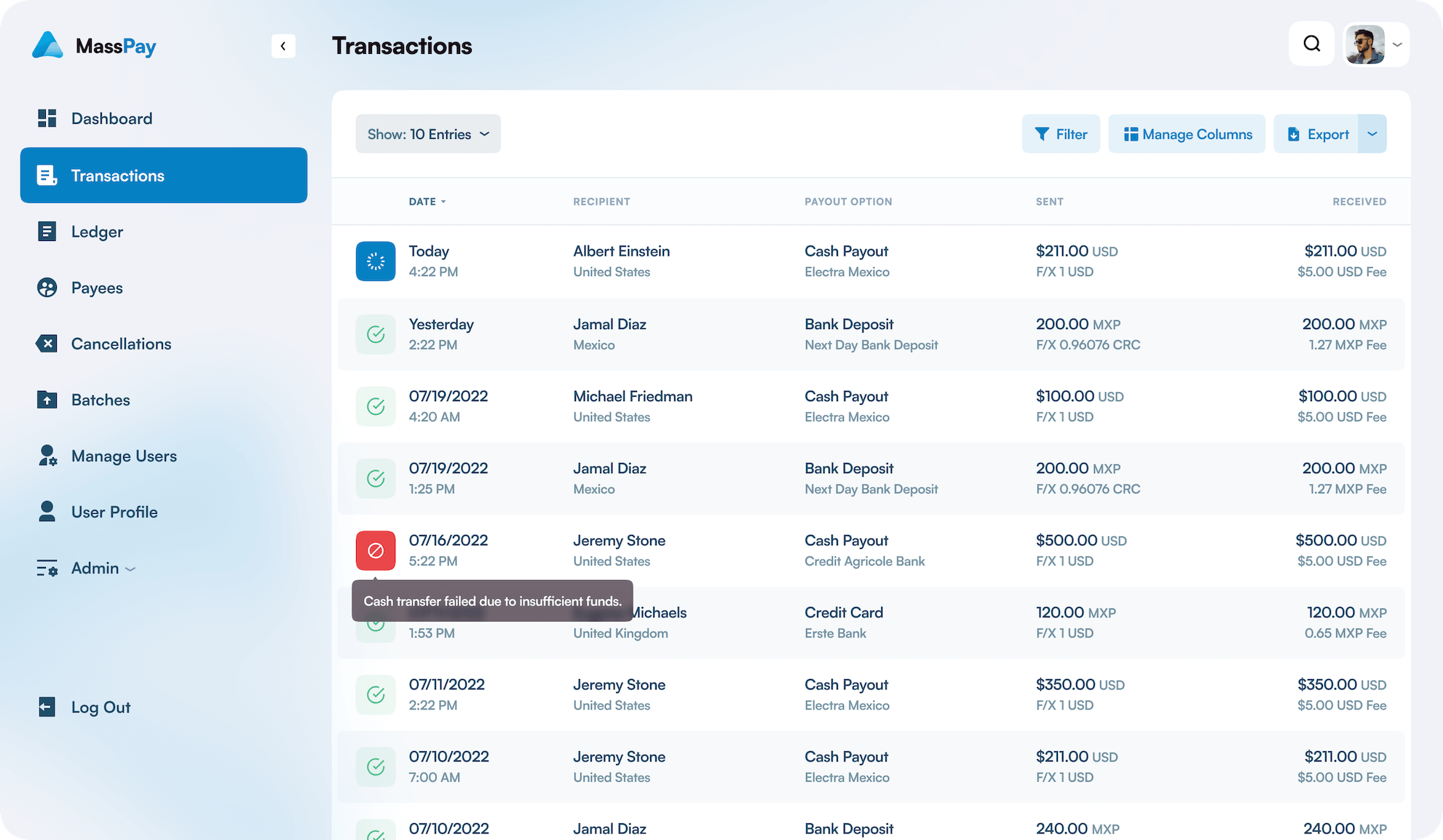

SINGLE PANE OF GLASS

FOR YOUR PAYOUT OPERATIONS

All of your payout operations are accessible from an easy to access, easy to use dashboard that is available wherever you are with whatever device(s) you prefer.

Cash & Cards

Payout to pre-paid debit cards or in cash.

Crypto

Payout in Bitcoin, Etherium & more.

Bank Transfers

ACH, Wires, Cash Pickup & Delivery.

Mobile Wallets

Payout to mobile & digital wallets worldwide.

Payment Methods

Payment Processing With International Settlement

Payment Processing With Domestic Settlement

Cash

![]()

![]()

Like many countries, cash remains a significant transaction method in Guatemala. Several payment platforms, like PayU, even facilitate cash payments through local convenience stores such as Punto Express, Banrural, Bantrab, and BAM, indicating the enduring importance of physical currency in the digital realm.

Credit and debit cards

![]()

![]()

As the digital spine of eCommerce, debit, and credit card payments dominate online transactions in Guatemala. With Guatemalan giants like Conekta and PagoFacil in play, merchants have the assurance that a vast majority of card brands are supported, widening the net of potential customers.

Bank transfers

![]()

![]()

Modern banking in Guatemala isn’t just about savings or checking accounts. Online banking has become the norm, offering users the convenience of round-the-clock fund transfers, bill payments, and swift access to account details. Platforms like PayU further facilitate bank transfers from various local banks—this adds another layer of convenience for customers.

Mobile Payments

![]()

Mobile payments are carving a niche in the Guatemalan market as smartphone penetration grows. Leading the way are platforms like Stripe, which support popular digital payment options like Apple Pay and Google Pay for a rapid, secure, and efficient payment experience on the go.

Electronic Funds Transfer (EFT)

![]()

EFTs, with their foundation in the secure electronic movement of money between bank accounts, are finding favor among Guatemalan businesses. By leveraging platforms such as TecnoCommerce, merchants facilitate EFTs and gain access to real-time transaction data, empowering them with more control and oversight in their payment processes.

Payouts in Guatemala

![]()

Apart from transaction facilitation, MassPay offers extensive disbursement services in Guatemala, allowing for secure and swift funds transfer to any bank account. Our vast alliance of local banks and service providers will enable businesses to facilitate payouts without concerns over exorbitant fees or extended delays.

Don't let traditional payment methods hold your business back in Guatemala. Embrace the growing digital landscape and tap into the market's full potential with MassPay's comprehensive payment solutions.

Detailed Reporting

COMPREHENSIVE DATA

Immediate access to real-time reporting provides comprehensive visibility into your operations. No matter what you're looking for, or where you're looking for it, it's right at your fingertips.