How US eCommerce and Digital Payments Lead the Global Paradigm Shift

The dynamics of business and commerce paradigms have shifted, and American eCommerce is playing a starring role.

The explosive growth of digital payments—marked by fingertip transactions, instantaneous transfers, and the quiet retirement of paper currency—signals more than just technological evolution—it also reflects a society advancing at digital speed.

We are navigating an era where convenience, security, and immediacy reign supreme. We will share some key trends, methods, and insights shaping eCommerce and payments in the United States to keep up with this ever-changing environment.

After all, as the second-largest eCommerce market in the world, it’s safe to say the trends and changes we see in this market will have a ripple effect on virtually every other eCommerce market in the world.

The United States defines innovation—what we do impacts and reflects what will follow in global eCommerce markets.

By the numbers: Unpacking USA eCommerce statistics

| In Q1 2023, US retail eCommerce sales reached $272.6 billion, marking an increase of 3.0% from Q4 2022 and a year-over-year growth of 7.8% from Q1 2023 | |

| By 2027, US eCommerce revenue is projected to reach 1.4 trillion US dollars, marking a new peak. | |

| In 2023, it’s easier than ever for merchants to accept virtually all consumer payment methods. That said, the four most popular are credit cards, debit cards, cash, and e-transfers. | |

| More consumers seek sustainability in their products—75% of Gen Z shoppers say sustainability is more important than brand names. Similarly, 32% of shoppers say they are willing to pay more for sustainable products and wait longer for them. |

| The US e-commerce market revenue is forecasted to rise by $509.4 billion (+54.19%) between 2023 and 2027. | |

| Payment methods vary within certain age groups in the United States. For example, Baby Boomers are most likely to still use checks, while millennials are inclined to use electronic money transfers. | |

| Of all retail sales in the US in Q1 2023, eCommerce sales made up over 15%. | |

| Currently, about 57% of online shoppers in the United States shop internationally, demonstrating an exciting opportunity for global brands. |

Be Part of the Innovation and Adaptability of the US eCommerce Industry

The United States stands as an emblem of change in the eCommerce and digital payment landscape. What happens here sets the stage for what follows in many other eCommerce markets in the world. With its massive influence and rapid adoption of new technologies, the US is more than just a market—it’s an innovator setting the pace for the world.

So, how can you establish your footing in this vast and competitive industry? It starts with turning to MassPay for a trustworthy global payment platform.

How MassPay Empowers American Merchants with a Global Payments Platform

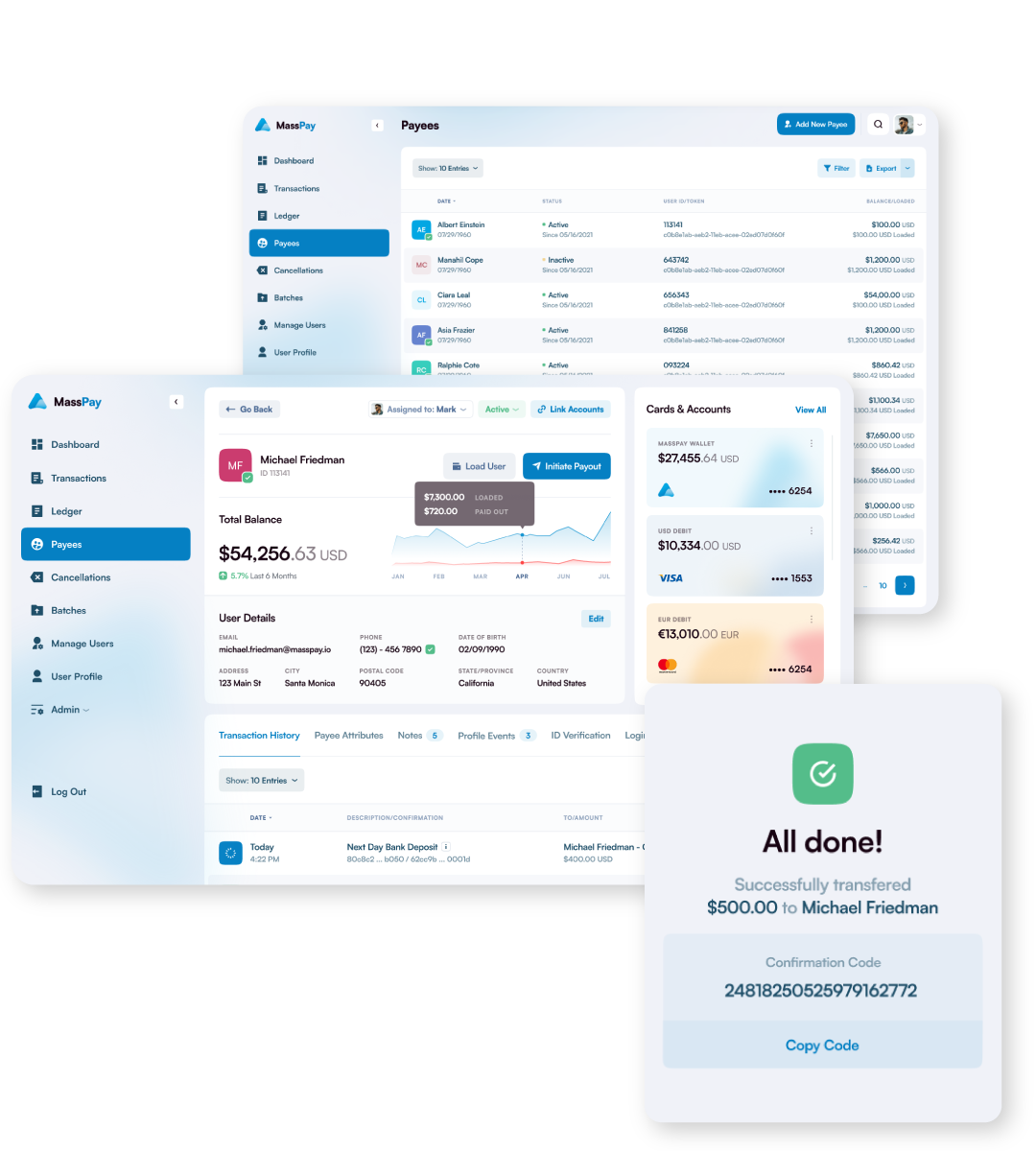

We understand that the US eCommerce market constantly changes, and MassPay is here to help you keep up. Our global payments platform offers a secure and reliable solution to ensure merchants receive their funds from customers anytime, anywhere.

MassPay provides competitive fees, transparent pricing, efficient processes, and 24/7 customer support for international money transfer services. With our global payments platform, you can easily manage alternative payments, cross-border payments, and keep up with the ever-evolving eCommerce industry in the United States.

So don’t let the rapid pace of US eCommerce trends leave you lagging behind.

Empowering Merchants in the USA’s Booming eCommerce and Fintech Landscape

We understand the US eCommerce market constantly changes, and MassPay is here to help you keep up. Our global payments platform offers a secure and reliable solution to ensure merchants receive their funds from customers anytime, anywhere.

MassPay provides:

Transparent pricing

Efficient processes

24/7 customer support for international money transfer services

With our global payments platform, you can easily manage alternative payments, cross-border payments, and keep up with the ever-evolving eCommerce industry in the United States.

So don’t let the rapid pace of US eCommerce trends leave you lagging behind.

Payout Types and Alternative Payments

American consumers demand convenience, variety, and speed regarding payments. That’s why MassPay offers a range of payout types to ensure your customers get what they need quickly and efficiently.

Whether you’re looking for physical check payouts, wire transfers, e-wallets, or even cryptocurrencies—we have the perfect solution for your business needs. With MassPay, you can ensure your customers’ payments reach them safely and securely, no matter where they are.

Payout Features

Now, let’s take a look at some of the features our platform provides to make global payments simpler and more efficient.

Flexible payment integration

MassPay’s API makes integrating with existing software and CRM systems easy—you can manage your international payments in one place.

Automated payments

Our automated process ensures payouts are sent out quickly and accurately—no need to worry about manual errors.

Easy setup

MassPay is designed to simplify businesses setting up a global payment plan. All you need is an internet connection and your company information.

Easy and swift

We know how important it is for your business to be global and adaptive—that’s why we’ve built our payout platform with this in mind.

Types of Payouts

Your customers must receive payments as conveniently and quickly as possible—otherwise, they’ll find someone else who can offer this to them. That’s why MassPay offers a range of payout options so you can meet their needs.

Whether you’re looking for physical check payouts, wire transfers, e-wallets, or even cryptocurrencies – we have the perfect solution for your business requirements. With MassPay, you can make sure your customers’ payments reach them safely and securely, no matter where they are in the world.

Execute payouts in over 70 currencies and 238 countries & markets, including the USA, UK, Europe, and Asia with MassPay.

That way, you can easily scale your business operations in any part of the world.

Top Features

Not just any payout platform will offer the features you need to stay competitive in today’s market. MassPay is dedicated to providing businesses with the best possible payout experience. Here are some of the features our platform provides:

| A one-time Know Your Business (KYB) process | |

| Access to over 70 currencies and 238 countries & markets | |

| Payment options such as physical checks, e-wallets, wire transfers, and cryptocurrencies |

| Automated process with minimal manual errors | |

| Convenient setup for businesses of any size | |

| Seamless integration with a Masspay API or the White Label Portal. |

MassPay is determined to provide businesses with the best payout experience possible. With our platform, you can ensure your customers’ payments reach them safely and securely, no matter where they are.

Start facilitating global payouts today and take advantage of eCommerce trends that elevate your business.

Payment Integration

We’ve mentioned seamless integration with MassPay’s API, but it’s worth exploring in more detail. With our API, you can facilitate global payouts with just a bit of code—it’s our platform, YOUR way.

Our API allows you to:

| Automatically convert currencies | |

| Integrate your existing payment system |

|

| Confirm payments in real time |

|

| Set up recurring payments |

|

| Manage payouts easily and securely. |

You can also customize MassPay’s White Label Portal for a more personalized experience. With the Portal, you can control everything from branding to recipient data fields.

MassPay's Visa Debit Program

In line with our commitment to offer our clients whatever they need to succeed in competitive global markets, we also have recently introduced a comprehensive Visa debit card program tailored for both payers and payees.

Features include:

Visa Branding

The cards carry the Visa brand, ensuring global acceptance at over 20 million merchants.

Card Options

Payees have the choice of a virtual card for online shopping or a physical card for in-store purchases.

Digital Wallet Integration

Cards are compatible with top digital wallets like Apple, Google, and Samsung.

Swift Activation & Access

Activation is quick, providing payees with immediate fund access. A virtual card ensures instant spending capabilities.

Domestic Limitation

The program is currently available only for U.S. residents, but global options can be discussed.

Visa's Global Reach

Real-time fund access for payees, making finance management convenient.

Branding Opportunities

MassPay allows businesses to co-brand the debit cards for an enhanced brand experience.

Furthermore, MassPay emphasizes customer support with a dedicated team of payout specialists ready to assist.

Transform Your Payout Process with MassPay

With MassPay’s streamlined KYB process and comprehensive range of global payout options, businesses can set up a payment plan to suit their customer needs quickly and efficiently. Whether you’re a small business looking to make global payments or a large enterprise looking for an end-to-end payout solution, MassPay has the perfect payment system for you.

Not only do we offer automated payouts in different currencies and regions, but we also provide unparalleled customer service. Plus, our secure platform keeps your customers’ data protected—read about our Identity Verification Service to see what we mean.

Stay Ahead of the Competition with Global Payments

The eCommerce industry is rapidly evolving, and staying ahead of the competition’s never been more critical. With MassPay, you can take full advantage of global payment trends that will help keep your business on top.

Start making seamless international payments today and reap the benefits tomorrow!