Introducing RTP Support for US-based Payees

Last week we introduced support for Zelle as a payout option our customers and their US-based payees.

1 min read

Chris Rechtsteiner

:

Sep 19, 2023 9:53:00 AM

At MassPay, we are always striving to make your payees' experience with us as smooth and efficient as possible.

Today, we're excited to announce that we have integrated Zelle® as one of our payout methods for all U.S.-based payees. 🎉

For those unfamiliar, Zelle® is a fast, safe, and easy way to send and receive money. It is widely used across the United States and integrates directly with many bank accounts, eliminating the need for third-party apps or additional sign-ups.

Payee's are choosing Zelle® for many reasons, including:

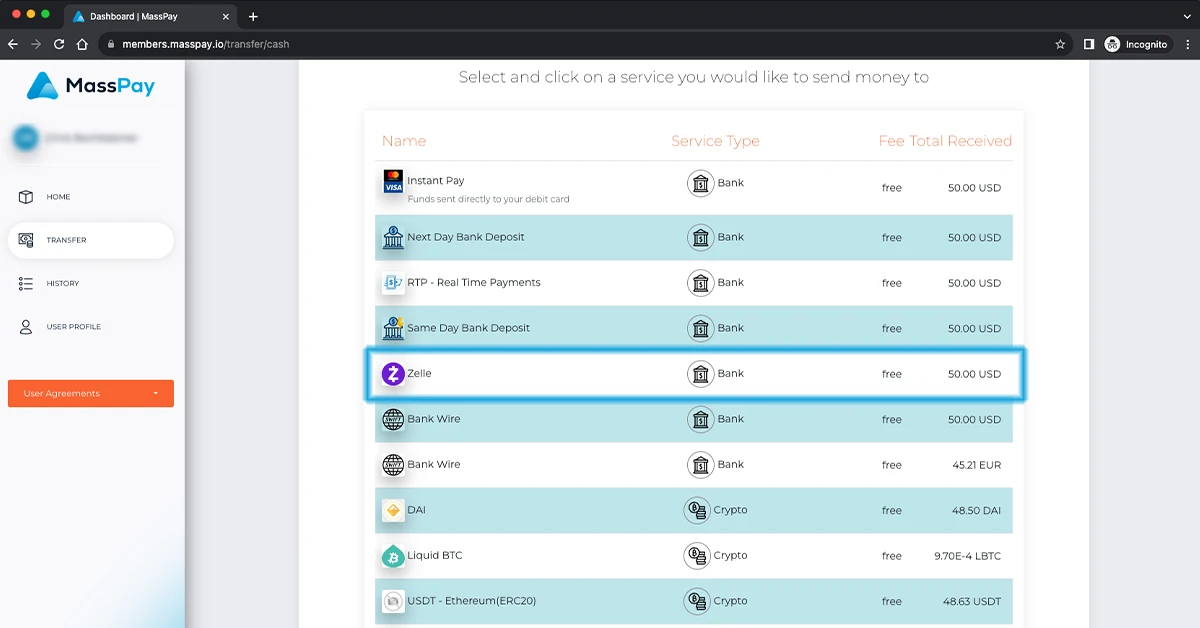

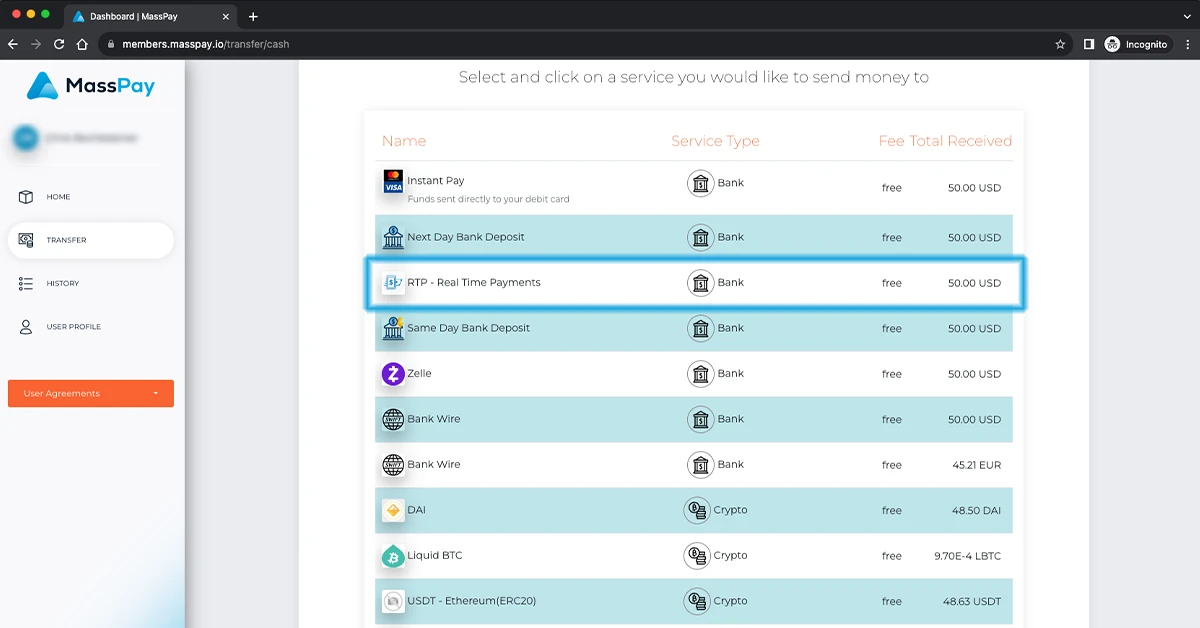

If you're already nodding your head and thinking, "This sounds fantastic! How do I get started?", here are the easy steps to set up Zelle® as your preferred payout option:

The addition of Zelle® to our platform provides our U.S.-based payees with yet another efficient, secure, and hassle-free payout method. We believe this will enhance your payees' experience and make transactions even smoother.

As always, our team is here to help.

If you have questions or need assistance, don't hesitate to reach out!

Zelle and the Zelle related marks are owned and operated by Early Warning Services, LLC.

Last week we introduced support for Zelle as a payout option our customers and their US-based payees.

What is Payout Orchestration? Payout orchestration is the process of efficiently managing, automating, and optimizing the way businesses disburse...

Despite its physical size, Indonesia has cemented itself as one of the top 10 largest eCommerce markets in the world. The country is experiencing...