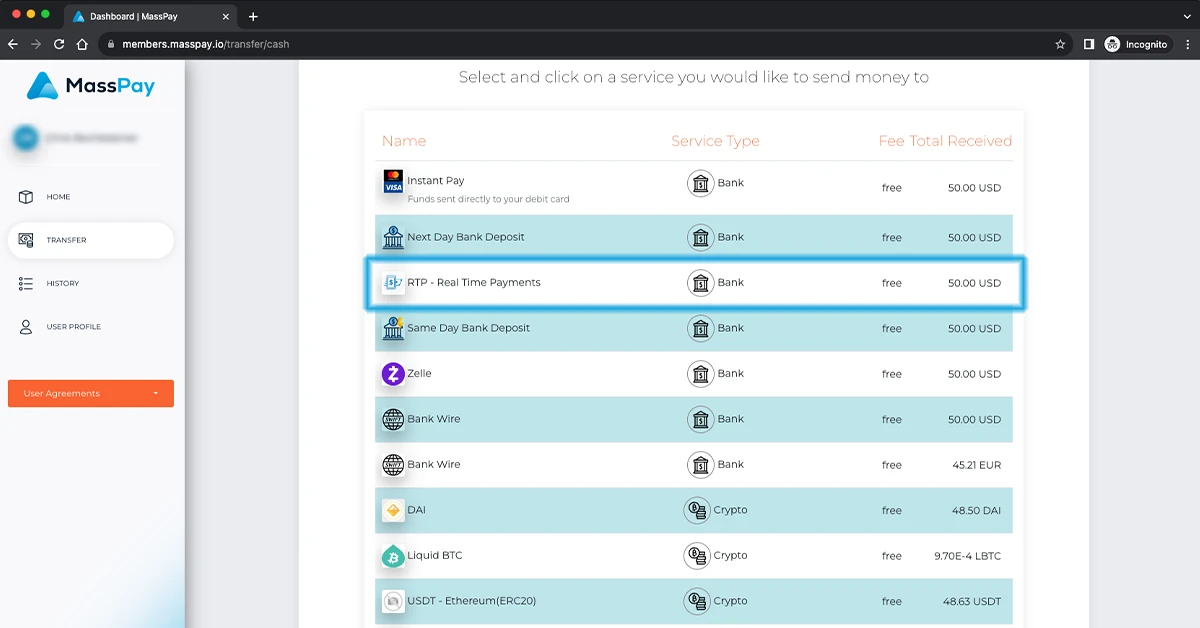

Introducing RTP Support for US-based Payees

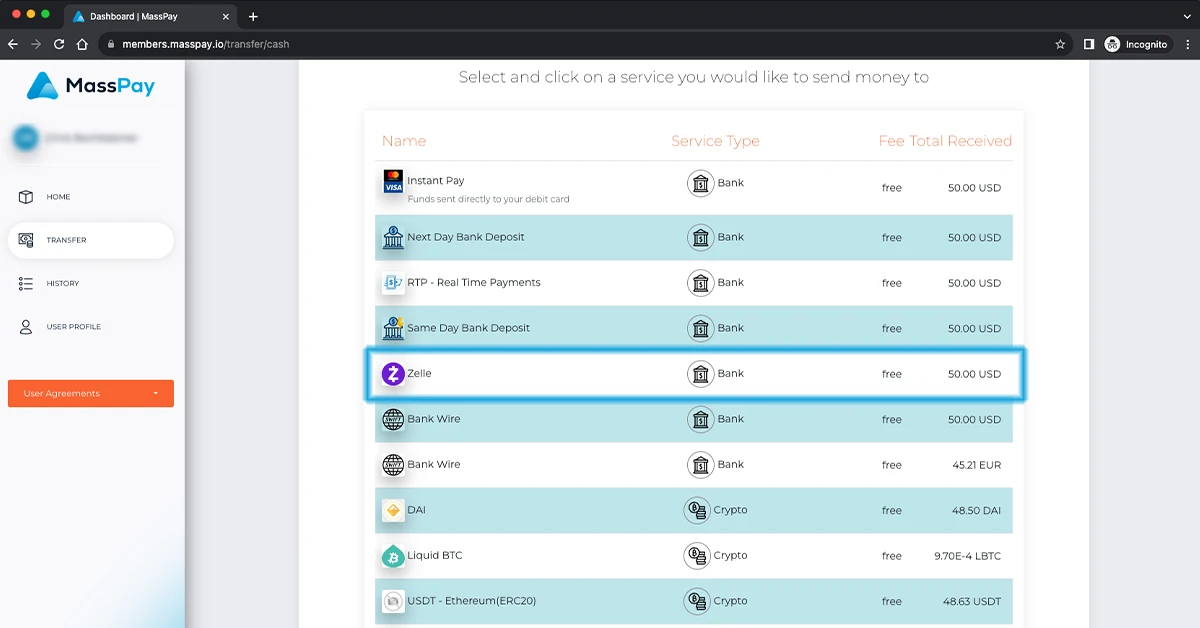

Last week we introduced support for Zelle as a payout option our customers and their US-based payees.

2 min read

Chris Rechtsteiner

:

Sep 12, 2023 7:03:00 AM

Traditional payment systems are constantly being challenged by innovative, more convenient, and sometimes cheaper alternatives. As these alternative payout methods (APMs) become more common, one question we frequently hear is:

Let's dive into this pertinent question and shed light on key trends that signify its relevance.

Depending upon your preferred independent research source(s), you can find that a significant percentage of payees – typically ranging from ~40% to as much as 60% – express a desire for alternative payout methods rather than traditional ones. This number is noteworthy as it signifies a broader shift in payment preferences, one that is rooted in convenience, efficiency, and adaptability.

There are several reasons for this increasing inclination:

For payees, the growing interest in alternative payout methods is more than just a trend; it's an opportunity.

The shift towards alternative payout methods is not just a passing phase but a reflection of the broader changes in our global economy and technological advancements. As the percentage of payees leaning towards these methods continues to grow, it's a clear indication for businesses and platforms to adapt and provide these options, ensuring they meet the demands and expectations of their stakeholders.

For payees, it's about embracing these changes for a more efficient, flexible, and secure financial future.

Start developing your APM strategy, today, with our Complete Guide to Alternative Payouts.

Last week we introduced support for Zelle as a payout option our customers and their US-based payees.

At MassPay, we are always striving to make your payees' experience with us as smooth and efficient as possible.

We're often asked what payment and payout methods are most preferred in a particular market. As we're focusing on Mexico this week, this is a perfect...